[[{“value”:”

Hemp Fiber Market Summary

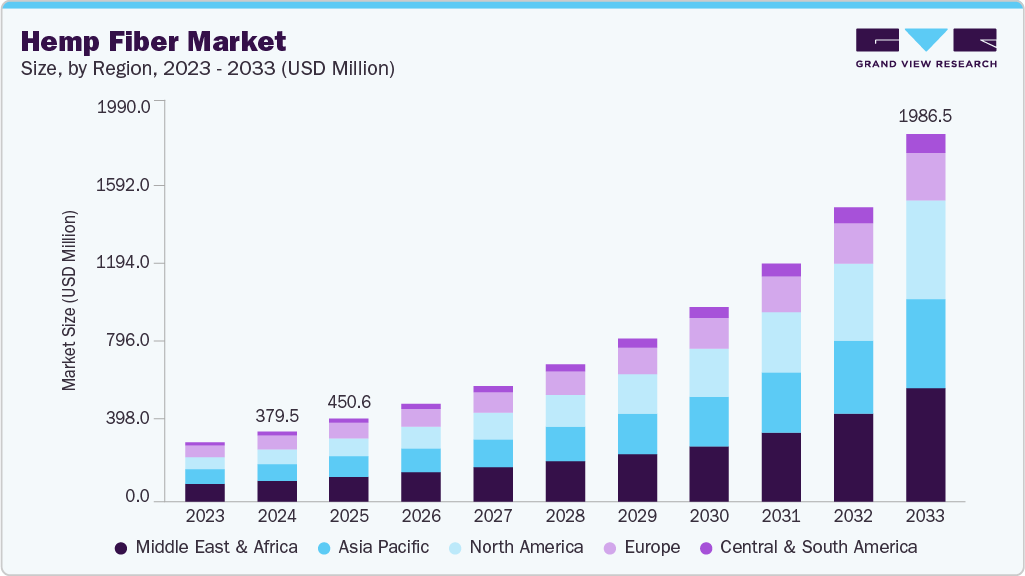

The global hemp fiber market size was estimated at USD 379.5 million in 2024 and is projected to reach USD 1990 million by 2033, growing at a CAGR of 20.4% from 2025 to 2033. This growth can be attributed to the increasing utilization of hemp fiber across industries such as textiles, automotive, construction, and personal care. Hemp fiber is valued for its sustainability, durability, and biodegradability, making it an attractive alternative to synthetic fibers.

Key Market Trends & Insights

Asia Pacific dominated the hemp fiber market with the largest revenue share of 24.2% in 2024.

The hemp fiber market in the U.S. has seen rapid expansion since the legalization of industrial hemp under the 2018 Farm Bill.

By application, the E-textiles segment is expected to grow at the fastest CAGR of 22.6% over the forecast period.

Market Size & Forecast

2024 Market Size: USD 379.5 Million

2033 Projected Market Size: USD 1990 Million

CAGR (2025-2033): 20.4%

Asia Pacific: Largest and fastest market in 2024

The push for eco-friendly materials, especially in fashion and packaging, is accelerating demand, particularly in regions focused on reducing carbon footprints and plastic dependency.

Technological advancements in fiber processing and material blending have enhanced the performance and versatility of hemp-based products. In construction, hempcrete and insulation materials are gaining traction for their thermal properties and low environmental impact. Government support through subsidies and favorable regulations for industrial hemp cultivation further propels market expansion, reinforcing its role in the transition toward a circular and green economy.

Prominent players in the market are investing in product innovation and vertical integration to strengthen their competitive edge and ensure quality control across the value chain. By overseeing cultivation, processing, and final product manufacturing, companies can maintain consistency, reduce dependency on third-party suppliers, and achieve cost efficiencies. This integrated approach also enables quicker adaptation to regulatory changes and shifting consumer demands.

In parallel, many manufacturers are forming strategic partnerships with sustainable fashion brands, automotive OEMs, and green construction firms to expand their application reach. These collaborations not only open new revenue streams but also reinforce hemp fiber’s positioning as a versatile, eco-friendly material aligned with global sustainability goals.

Market Concentration & Characteristics

The industry is moderately fragmented, with a mix of established players and emerging startups contributing to the industry’s growth. While no single company dominates the global market, regional clusters of production, especially in North America, Europe, and parts of Asia, are driving innovation and competitive differentiation. Market participants are investing in supply chain optimization, quality certification, and brand positioning to secure long-term contracts with industries such as automotive, construction, and textiles. However, regulatory uncertainties and inconsistent global policies regarding hemp cultivation continue to influence market concentration levels.

Despite hemp fiber’s eco-friendly and durable nature, it faces competition from both natural and synthetic substitutes. Traditional materials like cotton, jute, and flax remain strong contenders in the natural fiber category, especially due to established processing infrastructure. On the other hand, synthetic fibers like polyester offer scalability and cost advantages, posing a challenge to hemp’s widespread adoption. Nonetheless, growing consumer preference for sustainable alternatives and rising environmental regulations are gradually shifting the balance in favor of hemp-based products, especially in premium and niche market segments.

Application Insights

Fashion & Textile end-use segment held the highest revenue market share of 27.9% in 2024, driven by the rising demand for sustainable and biodegradable materials. Hemp’s natural durability, breathability, and antibacterial properties make it an ideal substitute for cotton and synthetic fabrics in eco-conscious apparel. Leading fashion brands are integrating hemp into their product lines as part of broader sustainability initiatives, while startups are capitalizing on its low environmental impact to attract green consumers. Additionally, hemp fiber’s versatility allows it to be blended with other natural or recycled fibers, expanding its application in clothing, home textiles, and accessories.

The e-textiles segment is expected to grow significantly at a CAGR of 22.6% over the forecast period. Innovations in conductive yarns and textile-based electronics are opening new avenues for integrating natural fibers into wearable technology. Hemp’s compatibility with nanomaterials and functional coatings makes it suitable for use in temperature-regulating fabrics, biometric monitoring wearables, and active sportswear. As R&D investments increase, especially in bio-based smart fabrics, hemp is gaining traction as a sustainable and functional alternative in this high-tech niche.

Regional Insights

North America hemp fiber market holds a significant share in the global industry, with the U.S. at the forefront following the 2018 legalization of industrial hemp. The region is witnessing rapid growth in applications such as green construction (hempcrete), sustainable fashion, and automotive bio-composites. There is a strong focus on building domestic supply chains, developing fiber decortication infrastructure, and enhancing value-added product innovation. Canada also contributes with established cultivation practices and a growing export focus. However, industry fragmentation, processing limitations, and evolving regulatory frameworks remain key areas for improvement.

U.S. Hemp Fiber Market Trends

The hemp fiber market in the U.S. has seen rapid expansion since the legalization of industrial hemp under the 2018 Farm Bill. Growing demand for sustainable materials in the construction, automotive, and apparel sectors is driving domestic cultivation and innovation. However, a lack of widespread fiber processing infrastructure and regulatory variations across states present growth challenges. To address this, investments are being made in decortication technologies and regional value chains to scale production and meet rising consumer demand.

Asia Pacific Hemp Fiber Market Trends

The hemp fiber market in Asia Pacific dominated and accounted for the largest revenue share of about 23.9% in 2024, driven by strong demand for sustainable textiles, bioplastics, and construction materials. While China leads in production and export capabilities with its well-developed infrastructure and policy support, other countries like India, Thailand, and Australia are emerging as new growth hubs. These nations are introducing favorable regulations, investing in industrial hemp cultivation, and exploring applications in eco-friendly packaging and apparel. The region benefits from low-cost labor and favorable climatic conditions, but challenges such as limited processing capacity and regulatory inconsistencies still need to be addressed for broader market maturity.

China hemp fiber market is supported by decades of cultivation experience and strong government backing in key provinces like Heilongjiang and Yunnan. The country has a well-established supply chain, from large-scale farming to advanced fiber processing facilities, making it a key exporter of hemp textiles and industrial materials. Ongoing investments in automation, eco-friendly processing, and textile innovation continue to solidify China’s leadership in the global hemp fiber market.

Europe Hemp Fiber Market Trends

The hemp fiber market in Europe is a mature and innovation-driven industry, with Germany leading in both cultivation and industrial applications. Strong sustainability mandates and EU-wide support for carbon-neutral materials are boosting the use of hemp in automotive interiors, construction materials like hempcrete, and biodegradable textiles. Collaborations between manufacturers, farmers, and research institutions are fueling R&D in high-performance hemp-based products.

Germany hemp fiber industry leads through strong environmental policies, advanced R&D, and integration into high-value sectors like automotive and green construction. Hemp is increasingly used in insulation panels, non-woven fabrics, and interior vehicle components. The country also promotes innovation through research collaborations focused on bio-composites and smart textiles. Germany’s commitment to climate targets and sustainable materials makes it a central hub for hemp fiber development in the EU.

Latin America Hemp Fiber Market Trends

The hemp fiber market in Latin America is growing, with countries like Brazil, Uruguay, and Colombia gradually developing industrial hemp sectors. Favorable climates, agricultural expertise, and growing investor interest position the region well for cultivation. The focus is on supplying hemp for textiles, eco-construction, and export markets. However, regulatory delays, limited processing infrastructure, and a lack of market awareness currently restrain large-scale growth.

Middle East & Africa Hemp Fiber Market Trends

The hemp fiber market in the Middle East & Africa is still at a nascent stage but shows promising potential. Countries like South Africa, Morocco, and Malawi are initiating hemp cultivation projects amid growing interest in sustainable agriculture and green building materials. While regulatory frameworks are still evolving, pilot projects and increasing government openness suggest a gradual path toward commercialization. Infrastructure development and awareness will be crucial to unlocking this region’s future market potential.

Key Hemp Fiber Companies Insights

Key players operating in the hemp fiber market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth.

Key Hemp Fiber Companies:

The following are the leading companies in the hemp fiber market. These companies collectively hold the largest market share and dictate industry trends.

HempFlax

Ecofibre

Hemp Inc.

GenCanna

HempCo

Konoplex

Dun Agro Hemp Group

Cavac Biomateriaux

BaFa

American Hemp, LLC

Hemp Fiber Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 450.7 million

Revenue forecast in 2033

USD 1.99 billion

Growth rate

CAGR of 20.4% from 2025 to 2033

Base year for estimation

2024

Actual estimates/Historical data

2018 – 2024

Forecast period

2025 – 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; ME&A

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; South Korea; Brazil; UAE

Key companies profiled

HempFlax; Ecofibre; Hemp Inc.; GenCanna; HempCo; Konoplex; Dun Agro Hemp Group; Cavac Biomateriaux; BaFa; American Hemp, LLC

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Hemp Fiber Market Report Segmentation

This report forecasts revenue growth at the global, regional & country levels and provides an analysis of the industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global hemp fiber market report on the basis of application and region:

Application Outlook (Revenue, USD Million, 2021 – 2033)

Fashion & Textile

Sportswear

Workwear

E-textiles

Others

Regional Outlook (Revenue, USD Million, 2021 – 2033)

North America

U.S.

Canada

Mexico

Europe

UK

Germany

France

Asia Pacific

China

Japan

South Korea

Central & South America

Brazil

Middle East & Africa

“}]] The global hemp fiber market size was estimated at USD 379.5 million in 2024 and is projected to reach USD 1.99 billion by 2033, growing at a CAGR of 20.4% from 2025 to 2033 Read More