[[{“value”:”

July 1 marks four years of legalized recreational cannabis use in Connecticut, and with legalization came major changes to the medical marijuana market.

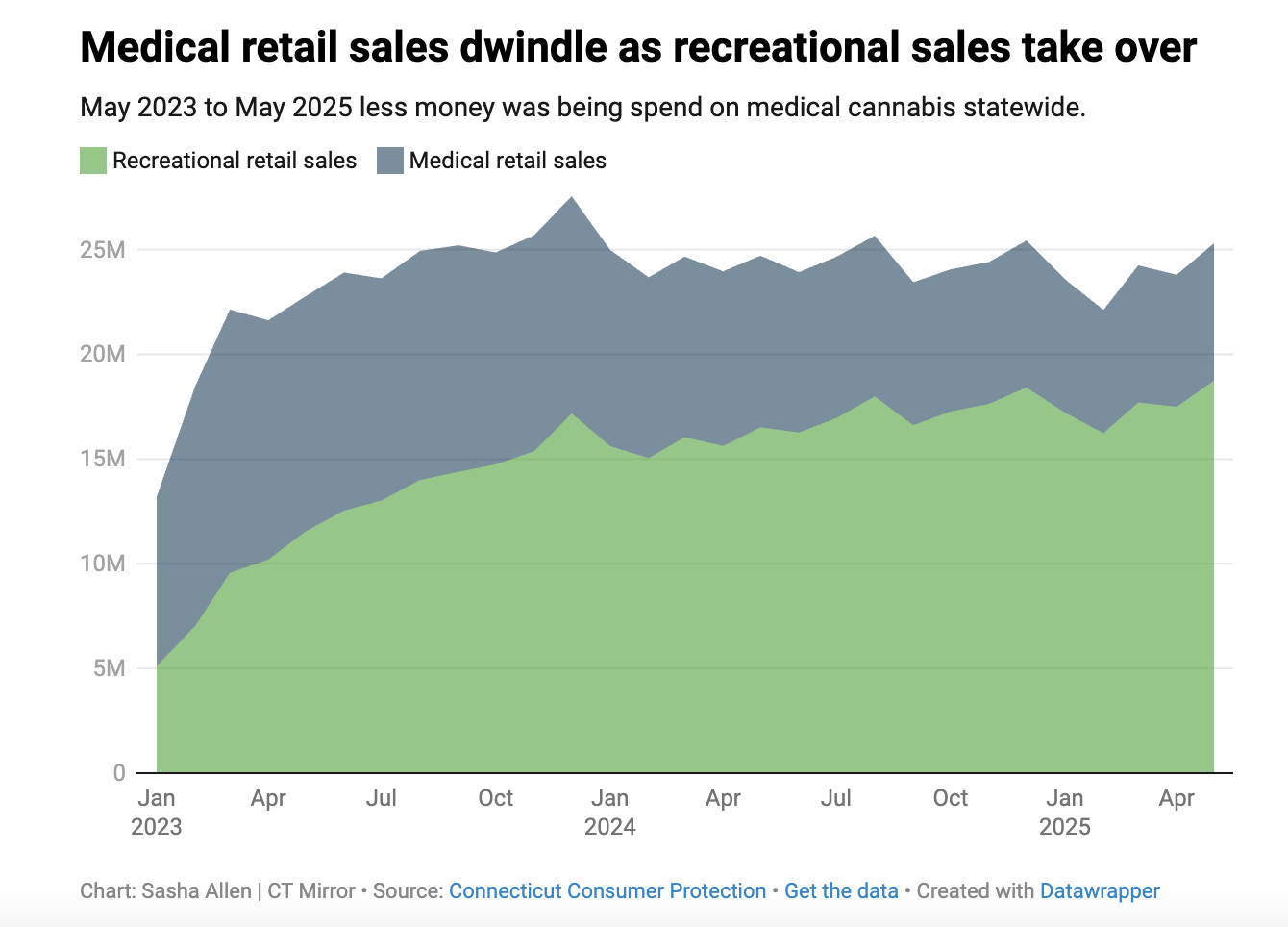

A law enacted in 2012 allowed the purchase and use of cannabis for medical reasons only. But in 2021, the state legalized recreational use for everyone 21 and older. Statewide recreational retail sales began in January 2023, and by May 2023, recreational sales accounted for the majority of state cannabis retail sales, a trend that has continued to today.

Connecticut was the 19th state to legalize recreational marijuana.

Under state law, anyone 21 or older without a medical card is allowed to possess up to 1.5 ounces of cannabis flower or other cannabis product equivalent in public and up to 5 ounces in their private residence. Medical cardholders can posses up to 5 ounces of cannabis on their person.

Not only have recreational sales increased, but medical purchases have made up less than half of the state’s cannabis market retail sales since May 2023.

Both medical and recreational dispensaries sell similar products, but medical users who are using the product to treat “debilitating medical conditions” aren’t subject to the cannabis tax. Medical users can also buy other products that recreational users cannot, including capsules, tablets, pills, sublinguals and suppositories.

Medical users are also not subject to potency restrictions, while recreational cannabis is currently capped at 30% THC for cannabis flower and 60% THC products other than vapes. However, as of Oct. 1, 2025, the cap for raw flower will be raised to 35% THC and 70% THC for concentrates other than vapes.

The cannabis tax is dependent on both the product and the amount of THC; edible products are taxed the most heavily per milligram of THC and plant products the least. For an eighth of flower that’s 15% THC, for the tax currently sits at around 9.4%, fluctuating based on product pricing. Edibles are subject to a tax of $0.0275 per milligram of the product’s total THC content.

Medical card holders are required to apply for renewal annually, which involves a consultation fee with health care providers that can range from $100 to $350 for user 18 and older. For users under 18, users must have a condition specified by the legislature for medical usage as well as parental consent and a caregiver arrangement.

Because cannabis usage is federally illegal, medical card holders are prohibited from purchasing firearms, and everyone applying for a firearm is required to disclose their usage of cannabis and other federally controlled substances. Federal law bars all cannabis users from owning a firearm.

Each hybrid or recreational cannabis retailer registered in Connecticut must pay the cannabis tax, which varies by product. The state cannabis tax brought in $21.3 million in state revenue for FY 2024.

Overall, the sales tax — along with state sales tax, municipality sales tax and licensing and conversion fees for dispensaries — brought in $49.4 million in cannabis revenue for FY 2024.

While there are dozens of products on the market, usable cannabis flower, which is just the dried plant, brings in the most sales across the medical and recreational markets. Overall, in May 2025, recreational cannabis retail sales were $18.7 million. Medical retail sales were $6.6 million.

There is only one exclusively medical dispensary in the state. The rest of the dispensaries have transitioned and cater to both the recreational market and the medical market as hybrid dealers, or just the recreational market.

Statewide, there are 36 recreational dispensaries and 35 hybrid dealers. However, the number of dispensaries fluctuates. Back in January 2023, only nine hybrid dispensaries existed. Numbers from around February 2025 showed 64 dispensaries in the state— eight fewer than are currently open.

“}]] As sales of recreational marijuana have increased in CT, sales of medical cannabis have dropped, and overall sales have held fairly steady. Read More