[[{“value”:”

Quick Navigation

Report OverviewKey TakeawaysBy SourceBy FormBy ApplicationBy Distribution ChannelKey Market SegmentsDriversRestraintsOpportunityTrendsRegional AnalysisKey Players AnalysisRecent DevelopmentsReport Scope

Report Overview

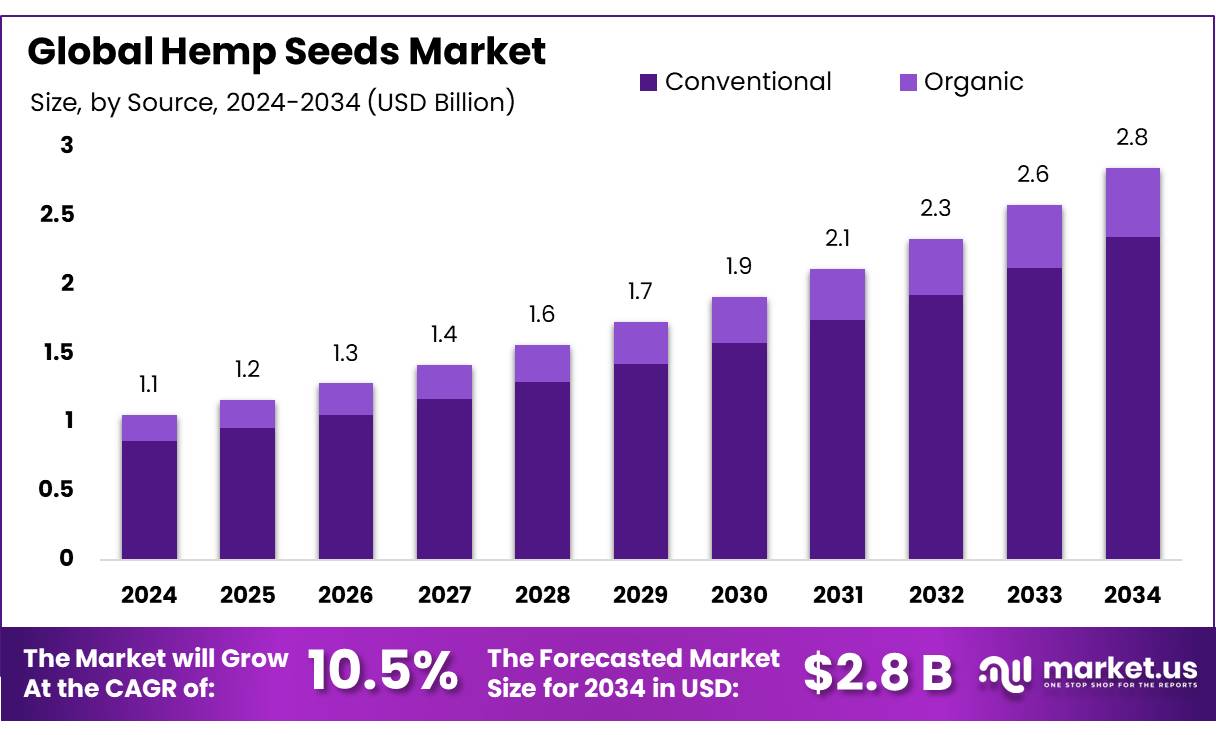

The Global Hemp Seeds Market size is expected to be worth around USD 2.8 Billion by 2034, from USD 1.1 Billion in 2024, growing at a CAGR of 10.5% during the forecast period from 2025 to 2034.

Hemp seed concentrates are gaining prominence in the food industry due to their exceptional nutritional profile and versatile applications. Rich in protein, essential fatty acids, and dietary fiber, these concentrates are increasingly utilized in plant-based food products, catering to the growing consumer demand for healthy and sustainable ingredients.

Government initiatives play a crucial role in the development of the hemp seed concentrate industry. In Canada, the Industrial Hemp Regulation Program, administered by Health Canada, permits farmers to cultivate low-THC cannabis for industrial use under controlled conditions.

This program includes a licensing system for cultivation, processing, and distribution, ensuring compliance with national standards. Similarly, the United States’ 2018 Farm Bill legalized hemp cultivation, facilitating the commercial production of hemp and its derivatives, including seeds for food applications.

The demand for hemp seed concentrates is further driven by their health benefits and sustainability. Hemp seeds contain all nine essential amino acids, making them a complete protein source, and are rich in omega-3 and omega-6 fatty acids in an optimal ratio. These nutritional attributes make hemp seed concentrates an attractive ingredient for various food products, including protein powders, energy bars, and dairy alternatives.

Key Takeaways

Hemp Seeds Market size is expected to be worth around USD 2.8 Billion by 2034, from USD 1.1 Billion in 2024, growing at a CAGR of 10.5%.

Conventional held a dominant market position, capturing more than an 82.4% share of the global hemp seeds market.

Hemp Seed Oil held a dominant market position, capturing more than a 29.8% share of the global hemp seeds market.

Food and Beverages held a dominant market position, capturing more than a 36.9% share of the global hemp seeds market.

Supermarkets & Hypermarkets held a dominant market position, capturing more than a 41.3% share of the global hemp seeds market.

By Source

Conventional Hemp Seeds dominate with 82.4% share in 2024 due to large-scale availability and established farming practices.

In 2024, Conventional held a dominant market position, capturing more than an 82.4% share of the global hemp seeds market. This dominance is mainly driven by its widespread cultivation methods, easier regulatory acceptance, and cost efficiency compared to organic varieties. Conventional hemp farming continues to be the preferred source in key producing countries such as Canada, China, and parts of the United States, where the infrastructure for large-scale commercial production is already in place.

Most food processors and manufacturers sourcing hemp seeds for protein powders, oil, and dietary supplements still rely on conventional supply chains due to their affordability and consistent yield. While organic hemp seeds are growing in interest among health-conscious consumers, the conventional segment continues to lead due to its proven scalability and established role in industrial and food-grade applications.

By Form

Hemp Seed Oil leads with 29.8% share in 2024 due to rising demand for plant-based nutrition and skincare uses.

In 2024, Hemp Seed Oil held a dominant market position, capturing more than a 29.8% share of the global hemp seeds market by form. The growing interest in plant-based health supplements, natural oils, and clean-label skincare products has driven significant demand for hemp seed oil. This oil is valued for its high content of omega-3 and omega-6 fatty acids, antioxidants, and vitamins, making it a popular ingredient in both the food and personal care sectors.

Consumers are increasingly turning to hemp seed oil for its potential health benefits such as improving heart health and reducing inflammation, which has supported its uptake across Europe and North America in particular. In 2025, demand for hemp seed oil is expected to grow steadily, especially as more brands introduce wellness and skincare products formulated with cold-pressed hemp oil. The segment’s growth is also supported by clearer regulatory pathways for non-CBD hemp products, encouraging its broader use in retail and food service sectors.

By Application

Food and Beverages lead hemp seeds use with 36.9% share in 2024, driven by demand for plant-based nutrition.

In 2024, Food and Beverages held a dominant market position, capturing more than a 36.9% share of the global hemp seeds market by application. This growth is mainly supported by the rising popularity of hemp-based ingredients in health foods, protein powders, baked goods, and dairy alternatives. Consumers are increasingly drawn to hemp seeds for their rich nutritional profile, including complete proteins, healthy fats, and essential minerals.

As awareness around clean-label, plant-based diets grows, food manufacturers are integrating hemp seeds into mainstream products ranging from energy bars to milk substitutes. In 2025, the food and beverage segment is expected to maintain its lead, especially in North America and parts of Europe, where consumer interest in natural and functional foods continues to rise. This trend is also supported by retailers and foodservice providers who are expanding their offerings to include hemp-based menu options and packaged goods, further driving demand across the segment.

By Distribution Channel

Supermarkets & Hypermarkets dominate with 41.3% share in 2024, thanks to wide consumer reach and product visibility.

In 2024, Supermarkets & Hypermarkets held a dominant market position, capturing more than a 41.3% share of the global hemp seeds market by distribution channel. This strong performance is mainly due to the growing consumer preference for purchasing health foods and supplements from large, trusted retail chains that offer convenience, variety, and in-store promotions.

These outlets provide dedicated shelf space for organic and plant-based products, including hemp seeds in the form of snacks, oils, protein powders, and cereals, which makes them more accessible to health-conscious shoppers. In 2025, this channel is expected to remain dominant as supermarkets continue expanding their natural food aisles and private-label hemp seed products. The availability of knowledgeable staff and transparent labeling further builds consumer confidence, especially in urban areas where awareness around nutrition and wellness trends is high.

Key Market Segments

By Source

Conventional

Organic

By Form

Hemp Seed Oil

Hemp Seed Protein

Whole Hemp Seed

Hulled Hemp Seed

Hemp Protein Powder

Others

By Application

Food and Beverages

Cosmetics

Nutritional Supplements

Industrial products

Pharmaceuticals

Personal Care Products

Others

By Distribution Channel

Supermarkets & Hypermarkets

Convenience Stores

Online

Others

Drivers

Government Support and Policy Reforms

One of the most significant driving factors for the hemp seed market is the robust support from governments worldwide, which has played a pivotal role in the industry’s growth. In the United States, the 2018 Farm Bill was a landmark legislation that legalized hemp cultivation, provided it contains less than 0.3% THC.

This federal endorsement opened the floodgates for hemp farming, leading to a surge in production and market value. According to the U.S. Department of Agriculture’s National Agricultural Statistics Service, the value of U.S. industrial hemp production reached $445 million in 2024, marking a 40% increase from the previous year.

Similarly, in Canada, the Industrial Hemp Regulation Program under Health Canada has been instrumental in promoting hemp cultivation. By providing clear guidelines and support for farmers, Canada has become a leading producer of hemp, with a significant portion of its production dedicated to hemp seeds for food applications. This regulatory framework has not only boosted domestic production but also positioned Canada as a key exporter in the global hemp market.

In Europe, countries like France, Germany, and the Netherlands have witnessed a 15% annual increase in hemp cultivation, driven by government-led initiatives to promote eco-friendly farming practices. These nations have recognized the environmental and economic benefits of hemp, leading to policies that encourage its cultivation and integration into various industries, including food, textiles, and construction.

Restraints

Regulatory Ambiguities and Market Uncertainty

Despite the growing interest in hemp seeds, the market faces significant challenges due to inconsistent and evolving regulatory frameworks. In the United States, while the 2018 Farm Bill legalized hemp cultivation, it inadvertently created a complex regulatory environment. The Food and Drug Administration (FDA) has yet to establish clear guidelines for the use of hemp-derived ingredients in food products, leading to uncertainty among producers and consumers. This regulatory ambiguity has hindered the full commercialization of hemp seeds in the food industry.

Furthermore, individual states have implemented varying regulations regarding hemp cultivation and product sales. For instance, Texas recently voted to ban nearly all hemp products, potentially devastating the state’s multibillion-dollar hemp industry, which consists of over 8,000 licensed businesses and supports tens of thousands of jobs. Such state-level inconsistencies create challenges for producers operating across multiple jurisdictions, increasing compliance costs and complicating supply chains.

These regulatory hurdles not only affect domestic markets but also impact international trade. Countries with stringent regulations on hemp-derived products may limit the export potential of hemp seeds, affecting global market dynamics. For example, the European Union classifies cannabidiol (CBD) and other cannabinoids as “novel foods,” requiring safety assessments before they can be marketed, which delays product availability and increases entry barriers.

Opportunity

Expansion of Organic Hemp Seed Production

A significant growth opportunity for the hemp seed market lies in the expansion of organic hemp seed production, driven by increasing consumer demand for organic and sustainably sourced ingredients. In the United States, consumer demand for organically produced goods surpassed $69 billion in 2023, accounting for about 4% of total U.S. food sales . This surge in demand has prompted initiatives to boost organic hemp production.

For instance, the U.S. Department of Agriculture (USDA) has awarded nearly $85 million to 106 projects in 36 states through the Organic Market Development Grant program. These grants aim to support the development of organic markets, including the expansion of organic hemp seed production . Such investments are crucial for meeting the growing consumer preference for organic hemp products.

In Canada, the trend towards organic hemp cultivation is also evident. Certified organic hemp production has become a growing trend, reaching more than half of total production, according to industry estimates. This shift towards organic farming practices reflects a broader commitment to sustainable agriculture and aligns with consumer preferences for organic.

Trends

Retail Expansion and Consumer Awareness

The hemp seed market is experiencing significant growth, driven by increased consumer awareness of its nutritional benefits and expanding retail availability. In the United States, the value of hemp production has seen a substantial rise, with the total value of hemp production reaching $445 million in 2024, up 40% from 2023. This surge is largely attributed to the growing popularity of hemp seeds as a nutritious food ingredient.

Hemp seeds are rich in essential fatty acids, protein, and fiber, making them a sought-after addition to health-conscious diets. Retailers are responding to this demand by increasing the availability of hemp-based products. For instance, shelled hemp seeds in 16 oz packages have been advertised at an average price of $13.18, reflecting their popularity among consumers.

Government initiatives have also played a crucial role in supporting the hemp industry. The U.S. Department of Agriculture (USDA) has implemented programs to promote hemp cultivation and ensure product quality. These efforts have helped stabilize the market and build consumer trust in hemp products.

Regional Analysis

In 2024, the Asia-Pacific (APAC) region emerged as the leading market for hemp seeds, capturing a dominant 46.3% share, equivalent to approximately USD 0.4 billion in value. This regional dominance can be attributed to a combination of favorable climatic conditions for hemp cultivation, long-standing agricultural practices, and recent regulatory easing in several key economies.

China continues to be a major contributor to APAC’s leadership, both as a top global producer and exporter of hemp seeds and related products. According to data from the Chinese Ministry of Agriculture, the country cultivates over 70% of the world’s industrial hemp, with provinces like Yunnan and Heilongjiang leading in seed production.

The region is also experiencing increased demand for plant-based and functional foods, aligning well with hemp seeds’ high protein and omega fatty acid profile. Growing urbanization, expanding health-conscious middle-class populations, and rising e-commerce adoption have further enabled the visibility and reach of hemp-based products across APAC markets. As regulatory clarity continues to improve and domestic production scales up, the APAC region is well-positioned to maintain its dominant share in the global hemp seeds market over the coming years.

Key Regions and Countries

North America

US

Canada

Europe

Germany

France

The UK

Spain

Italy

Rest of Europe

Asia Pacific

China

Japan

South Korea

India

Australia

Rest of APAC

Latin America

Brazil

Mexico

Rest of Latin America

Middle East & Africa

GCC

South Africa

Rest of MEA

Key Players Analysis

BAFA neu GmbH, based in Germany, is a prominent player in the European hemp seed market, focusing on the production and distribution of certified organic hemp seeds. The company is known for its strong compliance with EU organic regulations and supports traceable, non-GMO cultivation. BAFA supplies hemp seeds primarily for food and animal feed applications across Europe. Its partnerships with certified farmers and investment in quality control have positioned it as a reliable supplier in the expanding European hemp ecosystem.

Colorado Hemp Works is one of the first dedicated hemp grain processing companies in the United States. Located in Colorado, the company offers services including cleaning, hulling, and milling of hemp seeds for food-grade applications. It partners with local farmers and emphasizes non-GMO, pesticide-free hemp. The firm has seen increasing demand from protein and baking ingredient manufacturers across North America, with its operations benefiting from the regulatory support provided by the 2018 U.S. Farm Bill.

Dun Agro, based in the Netherlands, operates one of Europe’s most advanced hemp processing facilities. The company cultivates and processes hemp for a wide range of applications including food, fiber, and construction materials. Its hemp seeds are used both for cultivation and human consumption, with a strong focus on sustainable farming practices. Dun Agro’s vertically integrated model ensures quality control from field to final product, helping it meet the demands of European markets focused on traceability and eco-friendly products.

Top Key Players in the Market

BAFA neu GmbH

Canah International

Colorado Hemp Works (US)

Dun Agro

Ecofibre

GenCanna

GFR Ingredients Inc.

Hemp Inc.

Hempflax BV

Konoplex (Russia)

Liaoning Qiaopai Biotech Co., Ltd.

Manitoba Harvest

MH Medical Hemp

Nhempco

North American Hemp & Grain Co.

Recent Developments

In 2024 BAFA neu GmbH, approximately €25 million in revenue from hemp seed processing, reflecting a steady year-over-year increase of around 8%, driven by demand for certified organic seeds. BAFA operates a vertically integrated model—covering cultivation, dehulling, and fiber processing—ensuring full traceability from farm to finished product.

Colorado Hemp Works, based in Colorado, is the first U.S. commercial processor dedicated to hemp grain. In 2024, the company supported the processing of a portion of the 3.41 million pounds of grain hemp produced nationally—a volume that grew by 10% over the previous year.

Report Scope

Report Features

Description

Market Value (2024)

USD 1.1 Bn

Forecast Revenue (2034)

USD 2.8 Bn

CAGR (2025-2034)

10.5%

Base Year for Estimation

2024

Historic Period

2020-2023

Forecast Period

2025-2034

Report Coverage

Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments

Segments Covered

By Source (Conventional, Organic), By Form (Hemp Seed Oil, Hemp Seed Protein, Whole Hemp Seed, Hulled Hemp Seed, Hemp Protein Powder, Others), By Application (Food and Beverages, Cosmetics, Nutritional Supplements, Industrial products, Pharmaceuticals, Personal Care Products, Others), By Distribution Channel (Supermarkets and Hypermarkets, Convenience Stores, Online, Others)

Regional Analysis

North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA

Competitive Landscape

BAFA neu GmbH, Canah International, Colorado Hemp Works (US), Dun Agro, Ecofibre, GenCanna, GFR Ingredients Inc., Hemp Inc., Hempflax BV, Konoplex (Russia), Liaoning Qiaopai Biotech Co., Ltd., Manitoba Harvest, MH Medical Hemp, Nhempco, North American Hemp & Grain Co.

Customization Scope

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements.

Purchase Options

We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

“}]] Hemp Seeds Market size is expected to be worth around USD 2.8 Billion by 2034, from USD 1.1 Billion in 2024, growing at a CAGR of 10.5% Read More