[[{“value”:”

Home

»

»

GVR Report cover

Number of Report Pages: 101

Format: PDF

U.S. Hemp Fiber Market Summary

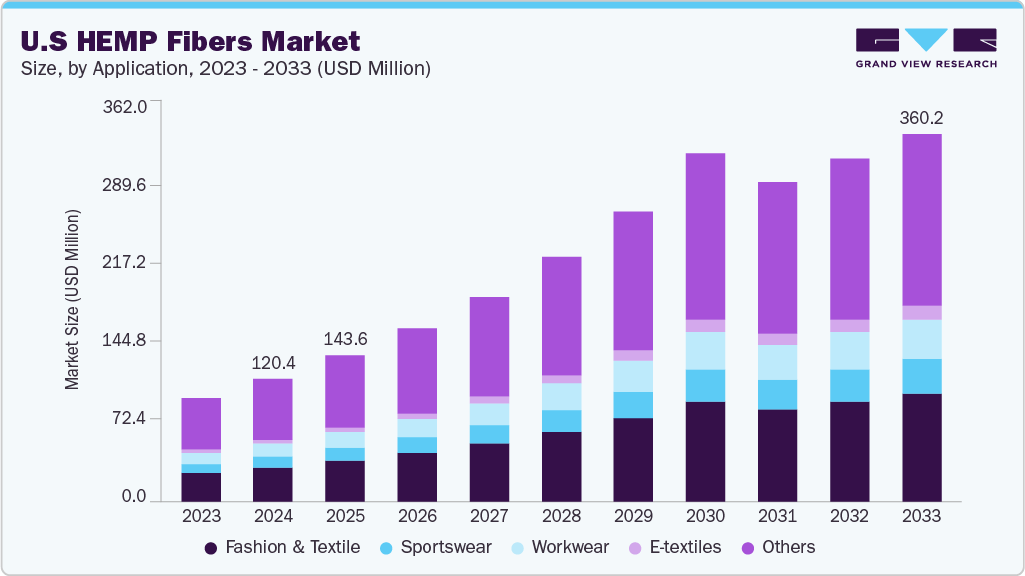

The U.S. hemp fiber market size was estimated at USD 120.4 million in 2024 and is projected to reach USD 360.2 million by 2033, growing at a CAGR of 12.2% from 2025 to 2033, due to growing environmental awareness, supportive legislation, and expanding industrial applications.

Key Market Trends & Insights

By application, E-textiles segment is expected to grow at the fastest CAGR of 14.4% over the forecast period.

Market Size & Forecast

2024 Market Size: USD 120.4 Million

2033 Projected Market Size: USD 360.2 Million

CAGR (2025-2033): 12.2%

Legalizing industrial hemp under the 2018 Farm Bill has encouraged large-scale cultivation and innovation, while consumers and manufacturers are increasingly seeking sustainable alternatives to cotton and synthetic fibers. Hemp’s eco-friendly properties, such as low water usage, biodegradability, and carbon sequestration, have made it attractive for use in textiles, construction, automotive components, and packaging. In addition, advancements in processing technology and increased adoption by major fashion and home goods brands are further propelling market growth. One of the primary market drivers of demand is the shift toward sustainable and biodegradable materials across industries. With increasing pressure to reduce carbon footprints and meet ESG goals, businesses are turning to hemp as a renewable raw material that requires fewer pesticides, less water, and regenerates soil health. The textile industry embraces hemp blends due to their durability, antimicrobial properties, and breathability qualities that resonate with environmentally conscious consumers. Moreover, government incentives, state-supported pilot programs, and the growing adoption of green building standards further accelerate using hemp-based construction materials such as hempcrete and insulation.

)

Innovation also plays a critical role in expanding the applications of hemp fiber in the U.S. market. Technological advancements in decortication and fiber processing have significantly improved efficiency, enabling the production of finer, softer fibers suitable for high-performance fabrics. Companies are developing prefabricated hemp-based panels and biocomposites for sustainable housing in the construction sector. In addition, hemp is being integrated into automotive parts for lightweight, durable plastic alternatives. Startups and established brands are experimenting with hemp in packaging, personal care products, and furniture, pushing the boundaries of hemp fiber’s commercial viability and positioning it as a cornerstone of the circular economy.

Market Concentration & Characteristics

The U.S. hemp fiber industry is moderately fragmented, with a mix of established players and emerging startups competing across various end-use segments. While a few companies like Hemp Inc., American Hemp LLC, and BastCore have established vertically integrated operations covering cultivation to processing, much of the market is still characterized by regional players and contract manufacturers. The absence of large-scale processing infrastructure in some states contributes to supply bottlenecks and uneven production capabilities. However, increased investments and strategic partnerships are gradually improving scalability and competitiveness. As the market matures, consolidation is likely, particularly among companies that can standardize quality and scale operations to meet growing industrial demand.

Product substitutes pose a notable challenge to the hemp fiber industry, particularly in sectors where conventional materials like cotton, synthetic fibers, fiberglass, and wood pulp are deeply entrenched. Cotton remains the dominant natural fiber in the apparel industry due to its widespread availability, established processing infrastructure, and consumer familiarity. Similarly, fiberglass and plastic composites dominate construction and automotive applications due to cost advantages and proven performance. However, rising concerns about microplastics, landfill waste, and environmental degradation are pushing industries to explore alternatives like hemp. The long-term success of hemp fiber will depend on its ability to offer comparable performance and cost-efficiency while aligning with sustainability objectives.

Application Insights

Fashion & textile held the highest revenue market share of 28.1% in 2024 in the U.S. due to the fiber’s favorable properties and alignment with the growing demand for sustainable apparel. Hemp is naturally breathable, hypoallergenic, UV-resistant, and highly durable, making it an ideal material for a wide range of clothing and home textiles. As consumers become more eco-conscious, there is an increasing preference for natural, biodegradable fabrics over synthetic alternatives like polyester or nylon. Major fashion brands and retailers are incorporating hemp into their sustainable collections, capitalizing on its minimal environmental impact and appealing to green-minded shoppers. In addition, hemp’s versatility allows it to be blended with other natural fibers like cotton or silk, expanding its application in mainstream fashion and premium textile offerings.

E-textiles is expected to grow significantly at a CAGR of 14.4% over the forecast period, driven by innovation and rising interest in smart clothing and wearable technology. When integrated with conductive threads or sensors, hemp fibers can be used in health-monitoring wearables, performance apparel, and military-grade smart textiles. Their moisture-wicking, antimicrobial, and breathable nature enhances comfort and functionality in electronic garments. As demand for wearable health devices and connected clothing accelerates, hemp-based e-textiles are gaining attention for their sustainability and adaptability. Startups and tech-driven apparel companies are increasingly exploring hemp as a base material for smart fabrics, contributing to rapid growth in this niche yet high-potential segment.

Key U.S. Hemp Fiber Company Insights

Some key players operating in the U.S. market include Hemp Inc. and American Hemp LLC.

Hemp Inc. is a vertically integrated industrial hemp company with over 14 years of experience in cultivation, processing, and education. They operate the largest hemp decortication facility in North Carolina and produce hemp fiber used for textiles, composites, and hempcrete alongside other products like Spill‑Be‑Gone sorbents and CBD-related offerings.

American Hemp LLC, based in North Carolina, specializes in supply chain development for industrial hemp and processing bast fibers, hurds, and fine dust for use in textiles, construction materials (including hempcrete), animal bedding, and clean-burning energy applications.

Industrial Hemp Manufacturing, LLC, and Hempitecture Inc. are some of the emerging market participants.

Industrial Hemp Manufacturing, LLC. is a subsidiary of Hemp Inc. It operates a 70,000 sq ft hemp processing plant in Spring Hope, NC, equipped with a decorticator to separate fibers from core. The company supplies hemp fiber for use in textiles and composite materials for the automotive industry.

Hempitecture Inc. is an innovative startup that produces hemp-based building materials like HempWool insulation and hemp-lime products. Supported by DOE funding (~$8.4M), it has facilities in Idaho and Tennessee and makes natural insulation, construction panels, packaging, and is exploring automotive textile applications.

Key U.S. Hemp Fiber Companies:

Hemp Inc.

American Hemp LLC

BastCore Inc.

Panda Biotech

Industrial Hemp Manufacturing, LLC

Formation Ag

Hempitecture Inc.

BioPhil Natural Fibers

Heartland Industries

South Bend Industrial Hem

Hemp Fiber Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 143.6 million

Revenue forecast in 2033

USD 360.2 million

Growth rate

CAGR of 12.2% from 2025 to 2030

Base year for estimation

2024

Historical data

2021 – 2023

Forecast period

2025 – 2033

Quantitative units

Revenue in USD million, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application

Country scope

U.S

Key companies profiled

Hemp Inc.; American Hemp LLC; BastCore Inc.; Panda Biotech; Industrial Hemp Manufacturing, LLC; Formation Ag; Hempitecture Inc.; BioPhil Natural Fibers; Heartland Industries; South Bend Industrial Hem

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Hemp Fiber Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the U.S. hemp fiber market report based on application:

Application Outlook (Revenue, USD Million, 2021 – 2033)

Fashion & Textile

Sportswear

Workwear

E-textiles

Others

“}]] The U.S. hemp fiber market size was estimated at USD 120.4 million in 2024 and is projected to reach USD 360.2 million by 2033, growing at a CAGR of 12.2% from 2025 to 2033 Read More